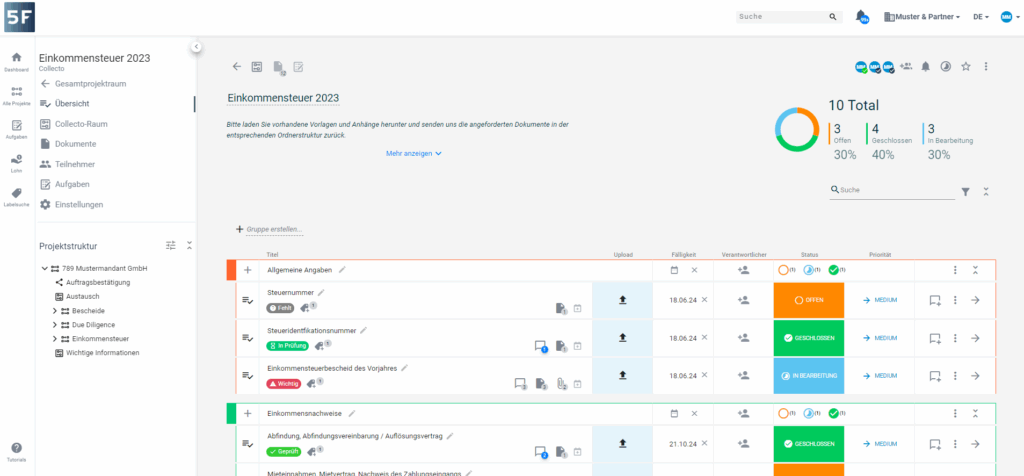

5f in Use in Tax Consulting: Examples

In addition to processing tax issues, effective client communication is particularly important in tax consulting. This is precisely where 5F comes in – an exchange platform that has been specially developed for the needs of tax advisors. With 5F, you not only exchange data securely and efficiently, but also take collaboration with your clients to a new level: No more time-consuming e-mail traffic, no USB sticks, no circulating files and no lost documents – just a single platform that enables you to concentrate on what is essential: advising your clients.

With 5F, you and your clients benefit from simplified workflows: Interactive checklists enable the simple and efficient collection of documents, communication takes place in 5F via encrypted project rooms, you can electronically sign documents directly in the platform in a legally compliant manner and, after completion, you can easily transfer all relevant documents to your further systems such as DATEV. Also included: the convenient upload of documents with the 5F app – as a service for your clients!

Digitize Tax Consulting with 5f – Advantages at a Glance: